Welcome to another issue of the Weekend Edition.

Thank you to all who’ve read and subscribed to the newsletter this week!

Here’s what we cover:

Market Recap - The Bulls are back

Macro - UoM Sentiment Data

Earnings Results

Premium Post of the Week - A look under the hood of the Oct CPI

The Week Ahead - Economic & Earnings Calendar

Closing Thoughts - look out for next week

Let’s dive in ⬇️

Market Recap - Nov 07 - Nov 11, 2022

The seemingly cooler than expected CPI certainly gave the market cause to celebrate. On Thursday, the Nasdaq-100 was up about 7.4%.

But, interestingly enough according to Charles Schwab’s Liz Ann Sonders, Thursday’s “7.4% gain for NASDAQ puts it in top 20 days going back to 1971 … of those largest moves, 16 were during bear markets”. So this seems to be a bear market rally just, quite a violent one.

Let’s look at what else happened:

The Dollar took quite a nosedive. The Japanese Yen and Swiss Franc was strongest against the Dollar.

Rates pulled back with the 10 year closing below 4%.

Junk Bonds, Technology, Homebuilders and Consumer Discretionary all caught a bid

The market is completely in “risk-on” mode. And most major technical momentum indicators are now bullish.

But under the surface, not much has changed.

We still have mortgage rates at over 7% and next week’s housing data probably won’t come in with great numbers. We also had DR Horton report earlier this week confirming that the housing market isn’t doing well. The guided to an additional 20-25% order cancellations in the next quarter.

The YoY inflation numbers came down but, the MoM numbers are still increasing. This is not particularly encouraging where you want to see prices actually reversing.

Even if the Fed decides to reduce the size of the hike to 50bps, it’s still a hike! Not a cut, and QT doesn’t stop.

If history is any guide, the Dollar peaks and begins to weaken once activity has bottomed, the Fed is easing and global growth starts recovering. None of this is true, right now.

Finally, we have the ominous yield curve which is still -0.51% (10Y-2Y inverted). The Yield Curve starts to correct in a recession.

The US and most other countries seem to bordering on Early Recession.

Macro of the Week

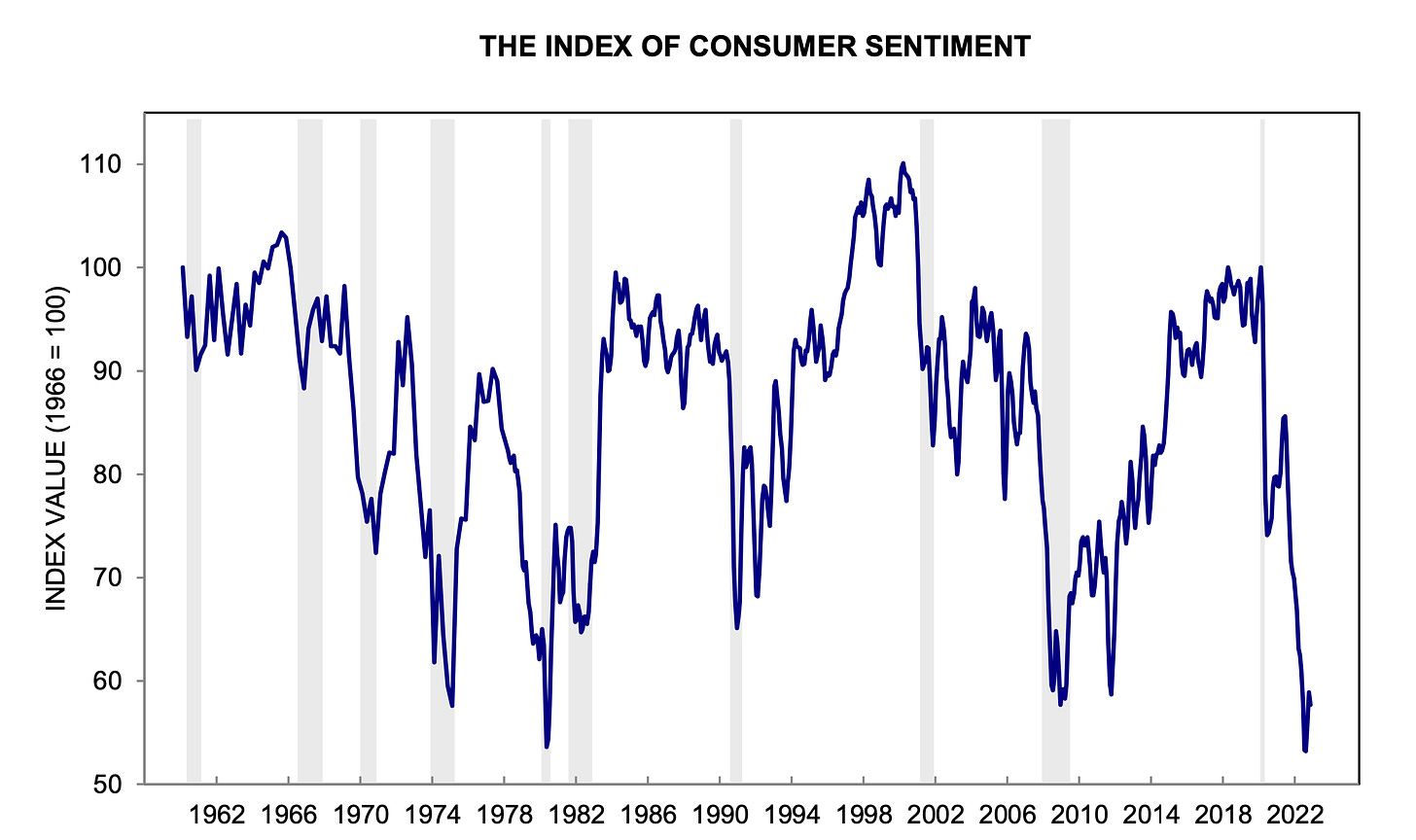

The University of Michigan Consumer Sentiment Index declined to 54.7 dropping 8.6%. from October. While it isn’t quite at the June lows of 50, this is still a clear sign that consumers are expecting worse financial conditions ahead.

Inflation expectations have increased but still remain within bounds. 5-10 year inflation expectations increased from 5% to 5.1% and longer term inflation expectations increased to 3%. But, consumers don’t think we are out of the woods yet.

Consumers are most concerned with higher interest rates and the effect it will have on their wealth. This concern was across the board, including higher-income consumers.

… buying conditions for durables, which had markedly improved last month, decreased most sharply in November, falling back 21% on the basis of high interest rates as well as continued high prices. - UoM Survey

Despite a strong labor market, consumers are also worried about unemployment going up in the next twelve months, according to the survey data.

The 50-year chart below shows that we have some of some of the worst readings compared to history and most of these low readings have coincided with a recession. The market may have celebrated a small win this week with inflation numbers coming in slightly cooler than expected but, this is still a troubling sign and one that the Fed does pay attention to.

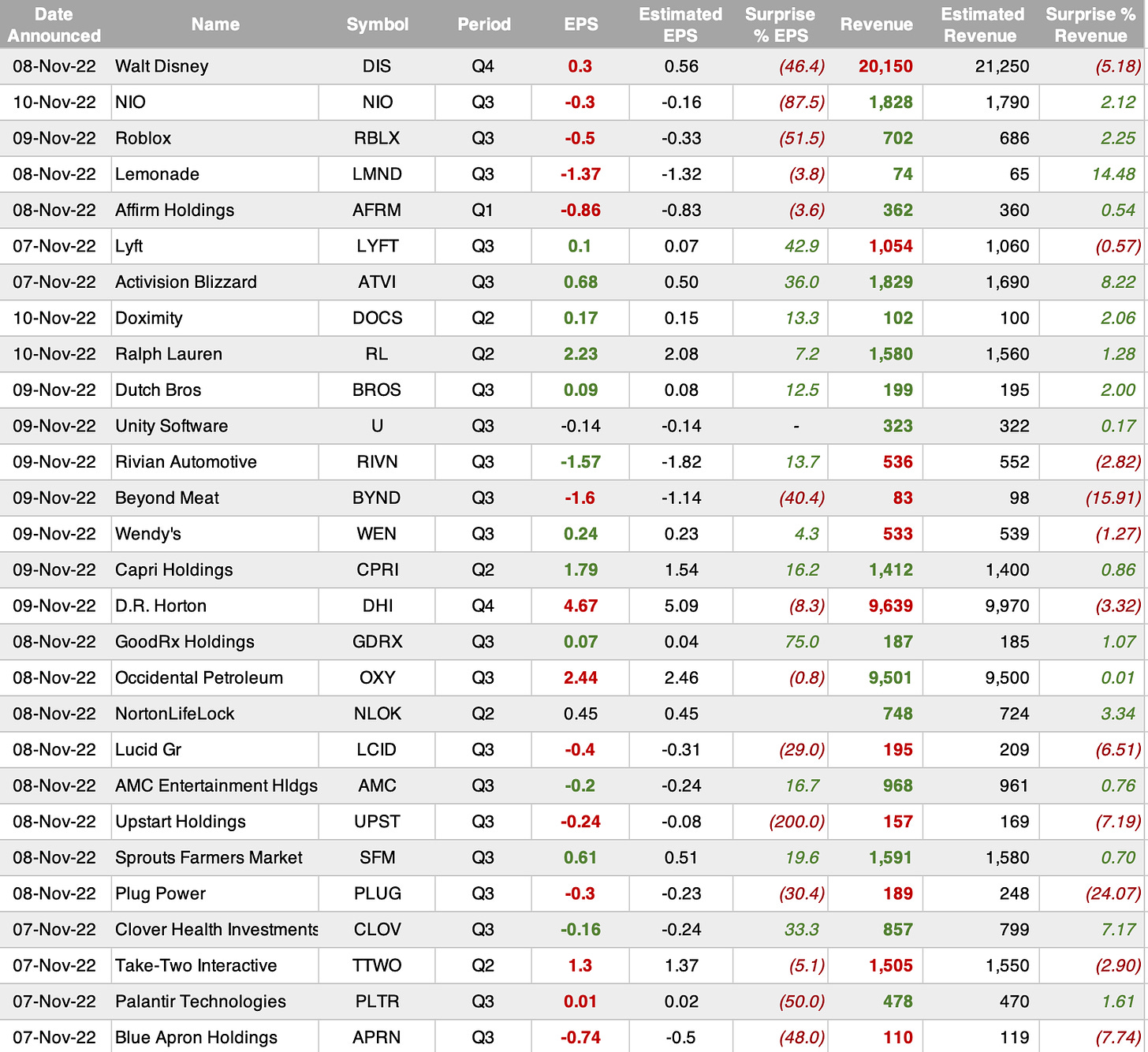

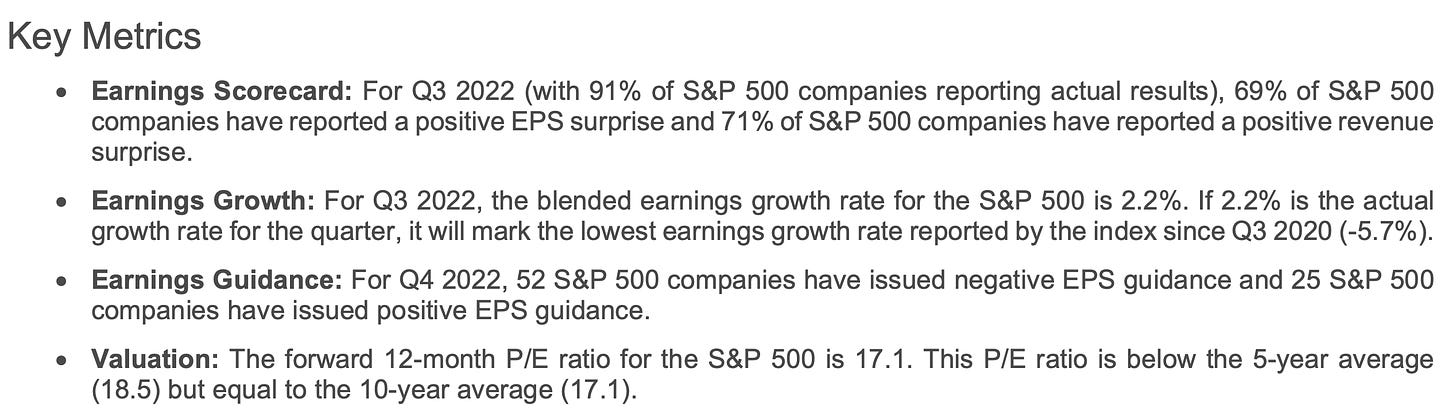

Earnings of the Week

Premium Posts - A look under the hood of the Oct CPI

7.7% sent the market skyrocketing

The Week Ahead

Earnings Calendar

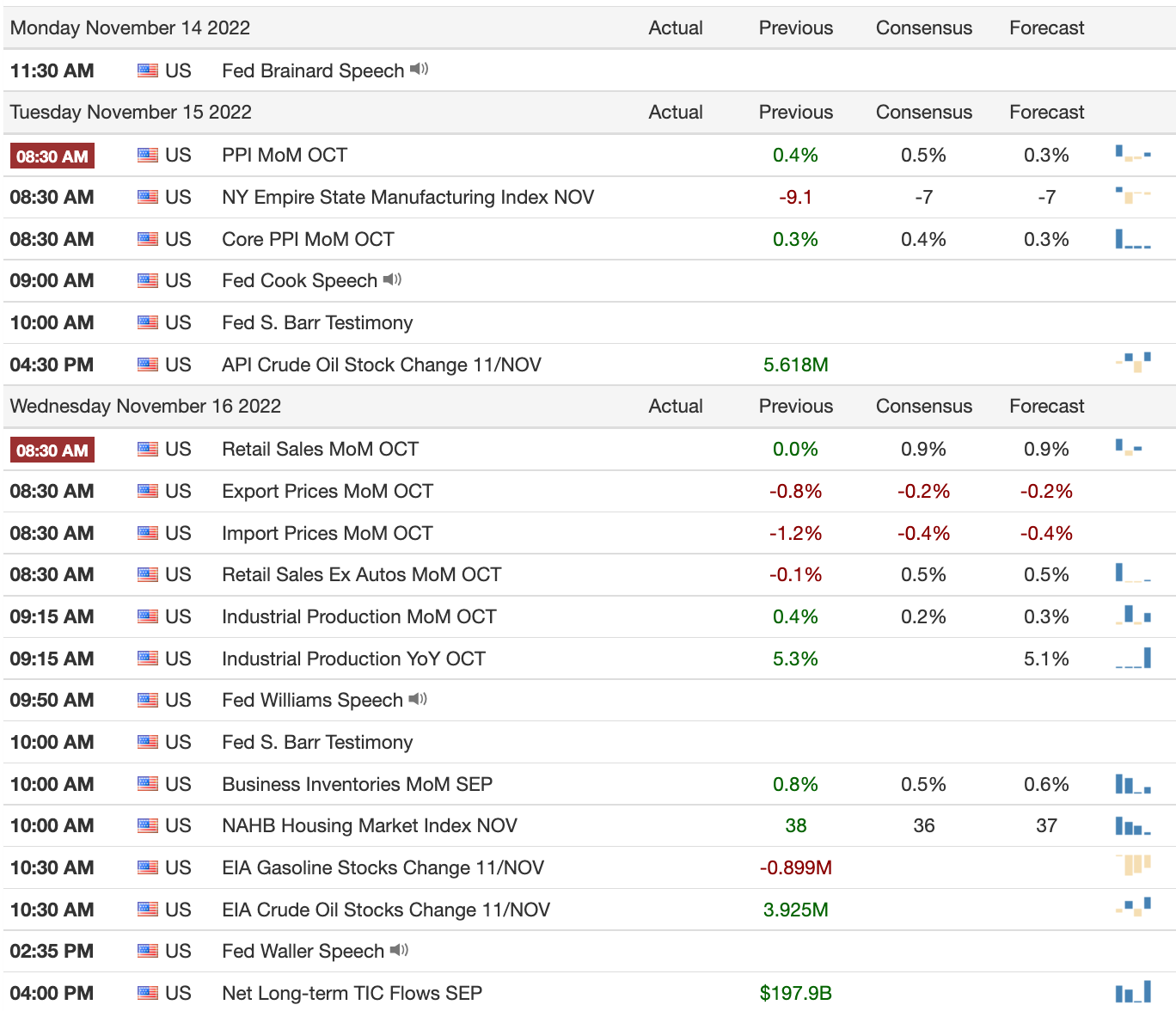

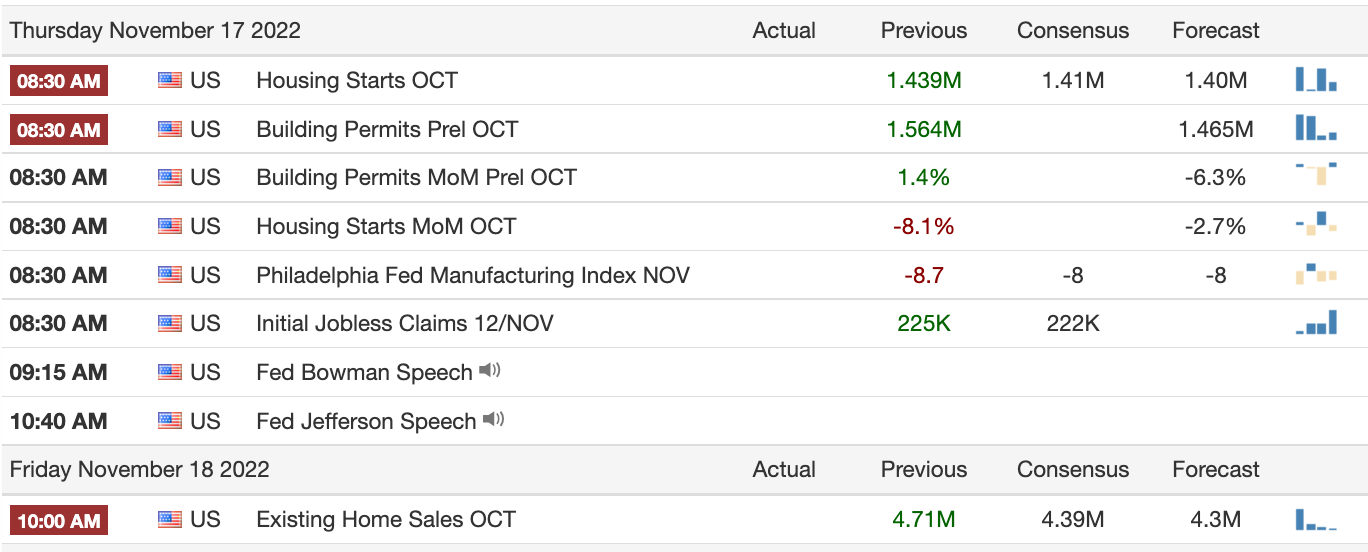

Economic Calendar

I apologize for the timings on the calendar for last week as a reader pointed out. The calendar hadn’t adjusted for daylight savings time.

Closing Thoughts - look out for next week

Bear Market Rallies are scary to chase unless you’re a short term trader. For the medium to longer term trader, it’s a great time to look at hedges either in the form of inverse ETFs or through “risk-off” sectors.

The market remains volatile and a single negative catalyst could bring everything down again. The underlying changes have not changed - interest rates are still above 4%, mortgage rates are still above 7% and inflation still remains 7.7%, which is still high. All these are enough to cause financial conditions to worsen, followed by economic conditions worsening.

We have some big earnings coming up next week, as well as, economic data releases including PPI, retail sales and housing data. It would be prudent to keep an eye on these.

Here’s wishing you a happy weekend and safe investing.

Please take a moment to share and subscribe, if you found this newsletter useful.

Sincerely yours,

Ayesha Tariq, CFA

There’s always a story behind the numbers

A promotion for all my subscribers until Nov 20, 2022

Sign up to any Traderade plan with my promo code NUMBERSTORY and get 20% off your first month or your yearly plan, including any trading courses.

Traderade is a community for retail by retail. We’re a learning community covering Macro, Technicals and Fundamentals to help you navigate the markets.

None of the above is Investment Advice. I may or may not have positions in any of the stocks mentioned. I have no affiliation with any of the companies that are mentioned.

Really appreciate that you've continued to keep these editions free. Thank you.

Some cold water in the form of common sense. Thanks!