The Weekend Edition # 44

Chopfest, Foodflation continues, Key Earnings Metrics, Calendars, Some exciting news

Welcome to another issue of the Weekend Edition and happy June!

Thank you to all who’ve read and subscribed to the newsletter this week!

Here’s what we cover this week:

Market Recap - Chopfest

Macro - Foodflation continues

Earnings of Week - Key Metrics

The Week Ahead - Economic & Earnings Calendar

Closing Thoughts - Some Exciting news

Let’s dive in ⬇️

Market Recap - 31 May to 03 Jun, 2022

The Markets have been choppy all week and we ended the week in the red. We saw some positive price movement early on in the week but the market still remains bearish overall and all the indices are under the key moving averages.

Interestingly, the Vix has come down by some margin, yet there’s still quite a lot of pressure across the markets. Some price action was driven by news and some by economic indicators and Fed speeches. Basically, the usual.

Much of the price action was driven by news:

Microsoft announced lower guidance citing foreign exchange pressures

Facebook announced the departure of Sheryl Sandberg, the COO

Tesla announced cutting 10% of their employees

Coinbase also announce staff cuts

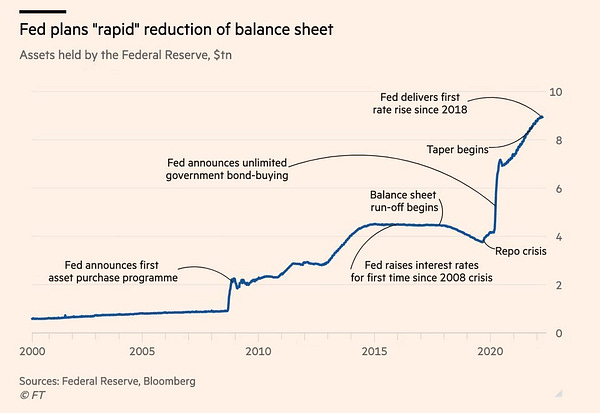

Needless to say, the smell of recession was in the air. We also had the start of QT on Jun 1, 2022, albeit without any fanfare. Here’s a good set of charts showing the effects of QT, which will probably not start to take effect until mid-June.

Macro - Foodflation continues

We’re seeing some softening in the prices for softs. Ok, that was a bad pun but, at any rate prices seem to have come down somewhat. Nevertheless, they are far from normalizing and remain at levels that are still too expensive for the average person. I don’t need to tell you, this means inflation still remains in the system.

Historically tight inventory levels

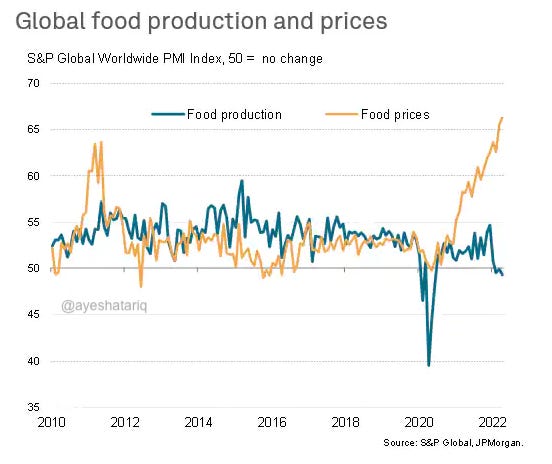

There’s been a host of weather-related events that have caused inventory levels to be lower than required. Not to mention decreased investment in the industry. Over the last two years, there’s been minimal change in global food production despite overall food prices increasing.

Input prices causing crop rotation or reduced plantation

There’s been a more than a five-fold increase in fertilizer prices over the past year, because of shortages exacerbated by the geo-political situation between Ukraine and Russia, two of the world’s major sources of fertilizer.

Given the rise in fertilizer price, we’re seeing crop rotations. More Soybean will be planted this season than corn, because corn is a fertilizer-intensive crop.

But the problem doesn’t just stop with the US planting. Globally, agriculture plantations are dwindling because of the rising cost of fertilizers.

Foodflation Continues

CPI data continues to show elevated prices in food. Grocery Items - Food at Home - has increased a whopping 10.8% YoY in April 2022.

The next CPI data comes out this Friday and watching the food numbers will be important. Food prices obviously, constitute quite a major portion of people’s income and more so for mid- to low-income households.

While the rate of change of inflation may be slowing to a certain extent, the level of inflation still remains high. Until food prices start to come down meaningfully, we will likely see that monetary policies to combat inflation will remain in place.

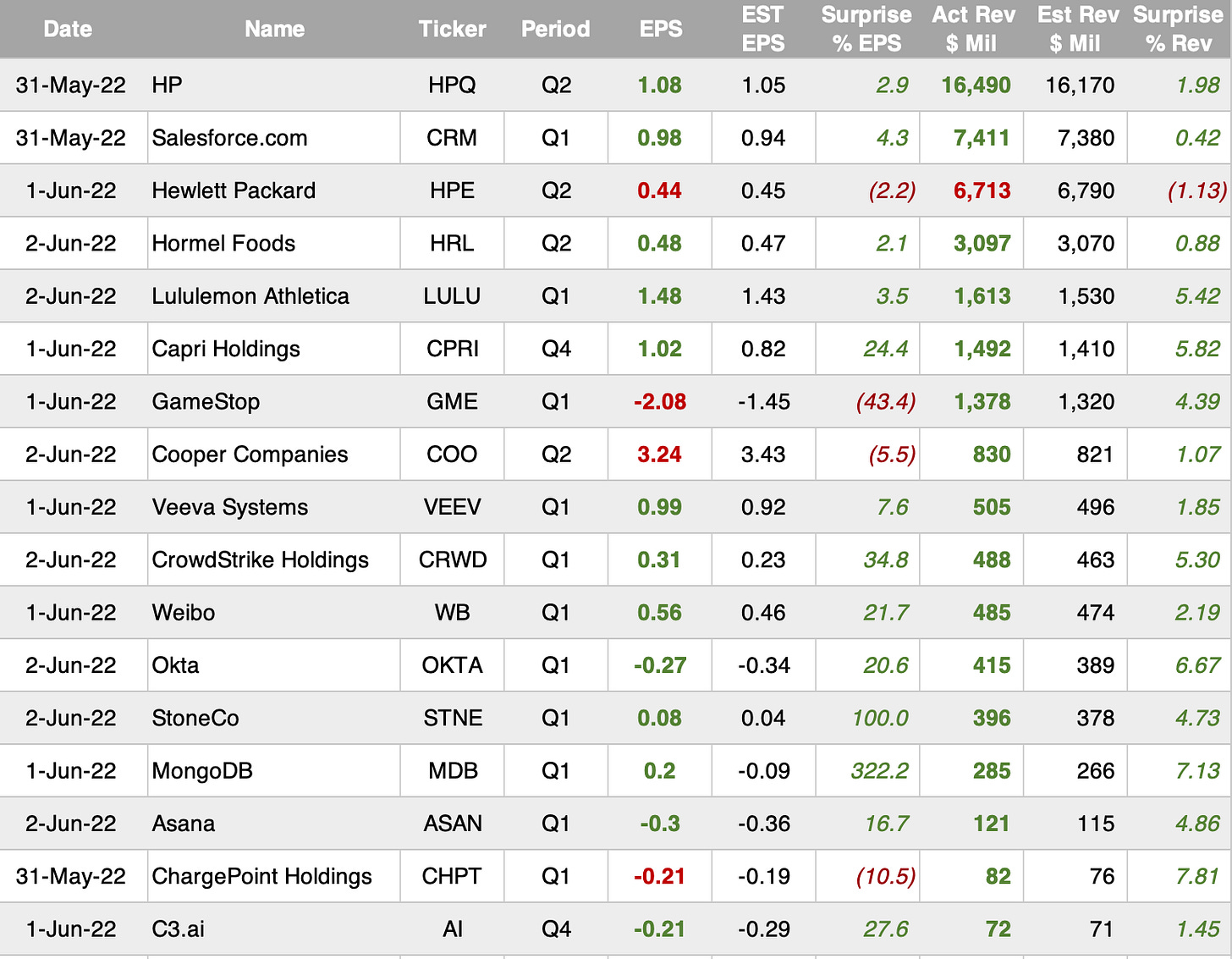

Earnings of the Week

The Week Ahead

Economic Calendar (time in ET)

Not much by way of economic indicators, except inflation numbers on Friday. At least no Fed speeches scheduled until now.

Earnings Calendar

Closing Thoughts - Exciting News

If you are a subscriber, I’m sure you received my email earlier this week saying that I am launching a Premium tier for this newsletter. The Weekend Edition will continue to remain free and will bring you a round up of the markets every week.

I feel it’s time to take my writing one step further and devote time to bringing you more content, which I hope you will find useful and engaging.

The Premium tier will also remain free for the entire month of June so you can see the kind of content that will be published and whether you wish to subscribe to the paid Premium tier thereafter for a nominal amount of USD 10 per month or USD 100 per year (essentially giving you two months free).

I am very excited for what’s to come and I do hope you will join me for the journey!

Here’s wishing you a happy weekend, and safe investing.

Sincerely yours,

Ayesha Tariq, CFA

There’s always a story behind the numbers

Sign up for a free trial to Barchart Premier with my affiliate link - Barchart Affiliate Link

None of the above is Investment Advice. I may or may not have positions in any of the stocks mentioned. I have a long position in $DBA as of the date of publication of this newsletter. I have no affiliation with any of the companies that are mentioned.

Good luck with the launch!

Great stuff