Welcome to another issue of the Weekend Edition.

Thank you to all who’ve read and subscribed to the newsletter this week!

A shorter edition this week. Here’s what we cover this week:

Market Recap

Macro Focus - Supply Chain

Earnings of Week - Summary

The Week Ahead - Economic & Earnings Calendar

Closing Thoughts

Let’s dive in ⬇️

Market Recap - 18 April to 22 April, 2022

A particularly brutal week in the market. Well, at least it was a brutal close. All the broad market indices experienced heavy selling, falling below their 50-day and 200-day moving averages. The Vix soared to 26.

Market breadth weakened with 87% declining issues on the NYSE and 74% declining issues on the Nasdaq. This is certainly not what we want to see in a healthy market.

The bond market is looking interesting. The Yield Curve is flattening yet again with the 10s-2s coming down toward the end of the week.

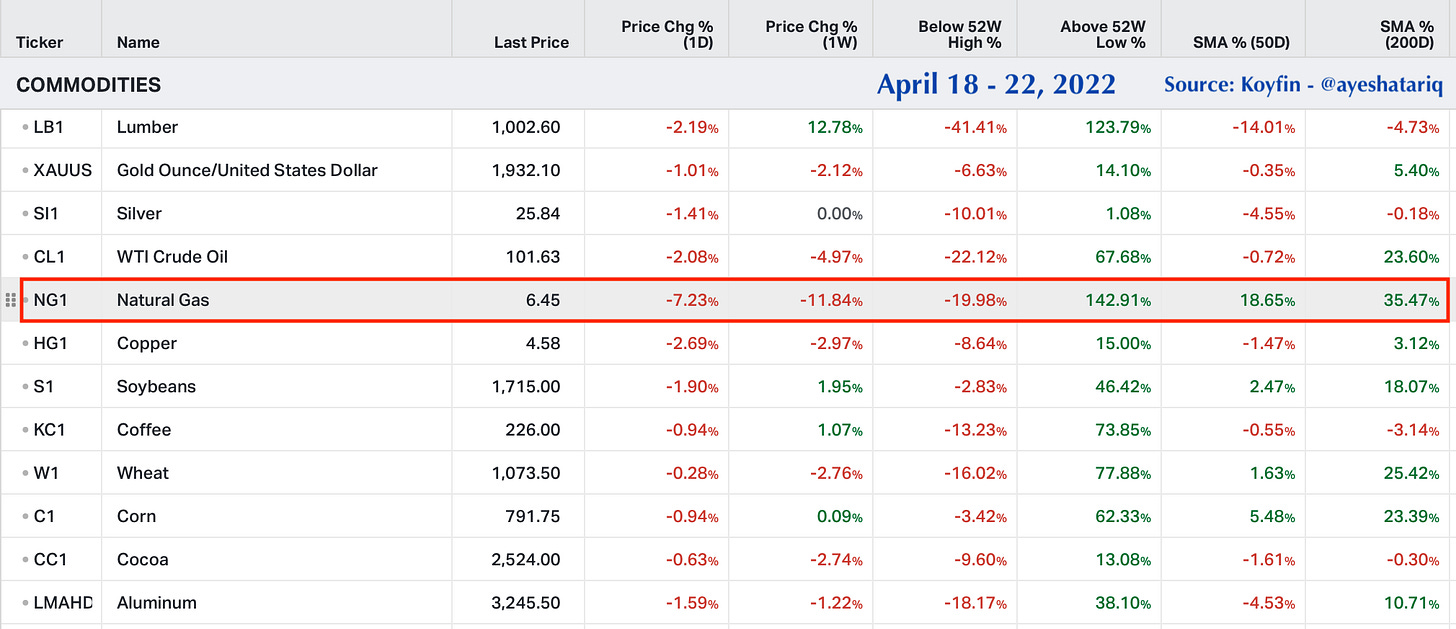

To round it all up, even the commodity market saw some decline during the week, with NatGas taking quite the hit after its parabolic move.

We’re about two weeks away from the next Fed meeting and we’re almost certain of the 50 bps hike. More importantly, we get to hear about their QT plans which is something we’re now waiting for with bated breath.

Macro Focus - Supply Chain

Let’s talk supply chain.

Over the last few weeks, we see people discuss how inflation may be peaking because the rate of change was the lowest in a while. This may very well be the case. However, let’s not discount the fact that the world is still in a supply chain crisis.

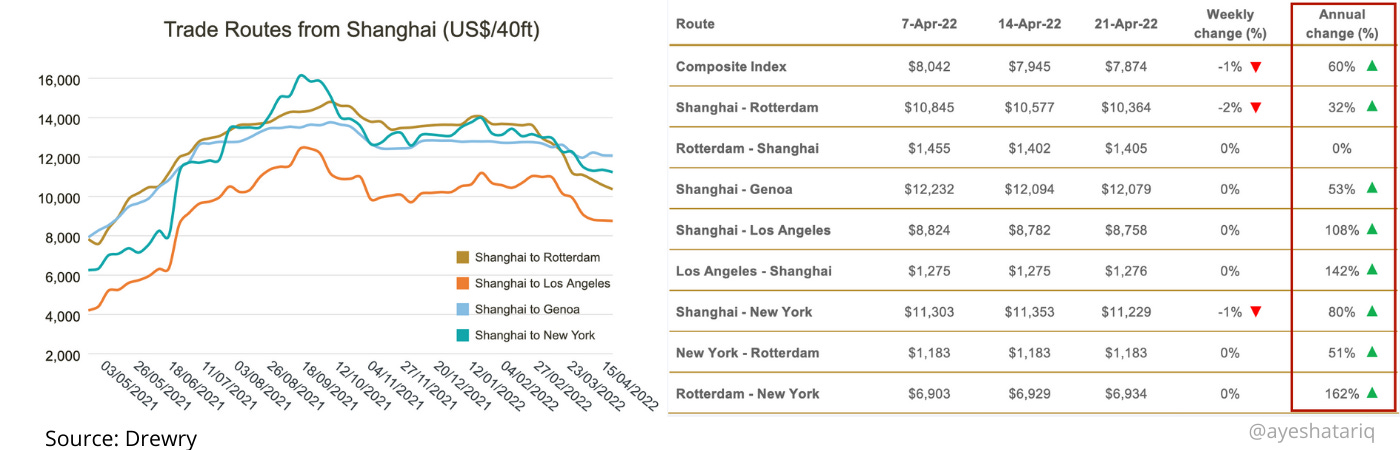

There’s some argument that freight rates are also declining. This is true to a certain extent from the data we see below. But, let’s not forget that the rates are still well above what they were. YoY increases (in the last column) are still are exorbitant levels.

However, rates declining slightly may not mean that the worst is over because we’re still faced with a number of geopolitical factors that are yet to play out in terms of price and volume.

The reaction we’ve seen in market prices for commodities and equities have largely been driven by sentiment and anticipation but, not the actual effects of a decline in supply or a supply chain problem. Think back to last year. Supply chain problems were forming well before it was translated into price.

Next up we have the conflict in Russia and Ukraine. European port congestions are building up. In Europe, much of the cargo that were to transported by trucks or train through Russian, now have to be transported by sea, not only because of the war but also because of sanctions.

Finally, we have China and their Covid lockdowns. With the widespread lockdown, trucking activity has declined and goods are now standing at the port waiting to be shipped. Trucking costs are up almost 300% because of driver shortages and and 120 container vessels are on hold at Shanghai’s ports.

There are two issues to the problem here - firstly, goods not coming out of China which delays the entire supply chain causing shortages and driving up costs. And, secondly, once lockdowns ease and factory production does resume, there will be a major glut of goods trying to enter the supply chain. This will cause yet another round of congestions and delays.

“Global port congestion has reached the highest levels ever recorded” to a record high of 14.1% of the total fleet as at 20 March, according to Linerlytica.

I don’t think we’ve seen the last of supply chain issues. When more of the retailers start to report, we will probably hear more about this. In the meantime, freight rates declining may just be temporary, and we see another round of supply chain issues which just may drive up freight rates and keep inflation at elevated levels.

The shipping stocks have pulled back over the last few weeks. It may be worthwhile to put them back on the radar.

Earnings of the Week

We’ve had a fair number of companies report earnings already. Here’s the FactSet Summary:

On the upside surprise factor, companies are still trending well. On the Growth factor however, earnings remains quite low. No surprise here, comparing numbers to Q1, 2021 and the prevailing macroeconomic headwinds has put significant pressure on companies to perform.

The Week Ahead

Economic Calendar

Earnings Calendar

Closing Thoughts

It’s safe to say the market got spooked. First, there were earnings. Netflix took a serious tumble and then Fed Chair Powell came out with a very hawkish speech of raising rates by 50 bps. The surprising thing is, none of this is new.

Next week we have a dizzying array of earnings and economic indicators. I suspect we see some serious movers once big tech reports. But, then again, even that’s not news. It would be a good idea to remain cautious as the market is looking weak and we may see further downside. So let’s stay sharp.

Here’s wishing you a happy weekend, and safe investing.

Sincerely yours,

Ayesha Tariq, CFA

There’s always a story behind the numbers

Sign up for a free trial to Barchart Premier with my affiliate link - Barchart Affiliate Link

None of the above is Investment Advice. I may or may not have positions in any of the stocks mentioned. I have a long position in $NUE, $KMI as of the date of publication of this newsletter. I have no affiliation with any of the companies that are mentioned.